Experienced Louisiana Hurricane Damage Insurance Claims Lawyer

Handling Storm Claims Since 2005

If your home or business suffered damage from Hurricane Francine, and your insurance company either denied your claim or did not pay full value, contact us for a free insurance claim review.

EXPERIENCE . JUSTICE . TRUST

Hurricane Francine Property Damage Insurance Claims Lawyer

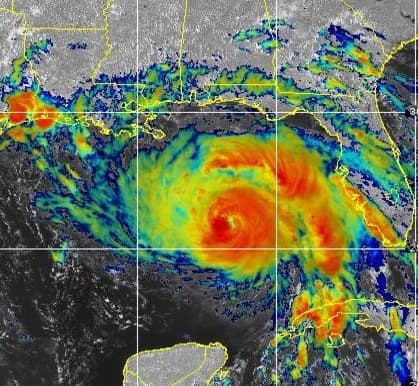

Hurricane Francine made landfall in Louisiana near Terrebonne Parish on September 11, 2024, with winds of 100 mph, classified as a Category 2 storm. The hurricane caused significant flash flooding, making many roads impassable and resulting in widespread power outages. Over 388,000 people in Louisiana, 52,000 in Mississippi, and 10,000 in Alabama were left without electricity.

In New Orleans, 6-8 inches of rainfall led to flash flooding, particularly in St. James and Jefferson Parishes. While most drainage pumps worked, residents were warned to avoid flooded areas. Lafourche Parish saw emergency rescues due to rising floodwaters, and property damage from downed trees was widespread across many parishes. Hard-hit areas included Morgan City, Dulac, Cocodrie, Kenner, and LaPlace, where extensive damage was reported.

Homeowners and Businesses now face the difficulty of cleaning up and rebuilding. Unfortunately, the storm may not be their worst nightmare. Home and Business Insurers are not accepting responsibility under the insurance policies they have both written and sold and are underpaying claims. We understand your concern and know how you feel. We have seen the same thing happen to hundreds of policyholders over the years before hiring us to handle their Hurricane Francine, Katrina, Rita, Gustave, Ike & Laura claims. We have seen the difference a Hurricane Lawyer can make.

Let us use our 29 years Experience to help your legal claim

Please fill out the form and we will get back to you shortly.

How To Avoid Losing Hurricane Francine Property Damage Insurance Claim Benefits

Look for your insurance policy and related insurance records. Make sure you are familiar with any hurricane deductible that applies to your specific insurance policy. If you cannot find a copy of your policy, call your insurance company or insurance agent and request a copy;

Give notice to your insurance agent and company or companies immediately, preferably in writing. The notice should include at least the location of the loss, the date and time of the loss, the policy holder’s name, phone, email and fax number, and a brief description of the loss;

Slow Service? Excuses? Denial of Your Hurricane Property Damage Insurance Claim?

Do not accept slow service, excuses, or denials of your storm claims. If the insurance company refuses to pay the full amount owed, refuses to negotiate or engage in continuing negotiations over the value of your damage, and fails to continue to respond promptly to your questions, they may have broken the bad faith laws.

Your insurance company is required to timely pay your claims for all of your damages covered by the policy.Your insurance policy may provide coverage for physical damage to your property, extra expenses incurred, and lostbusiness income. If you have Disaster Mortgage Protection, the insurer is required to timely pay your monthly mortgage, reimburses your structural deductible, and can help pay down your mortgage balance in the event of certain damages are sustained in a hurricane, flood, or other disasters

three steps to success

We Will Help You Every Step Of The Way

01

First Consultation And Case Review Are Free

02

Contingency Fee

03

Our Process

Types Of Claims We Handle

How The Louisiana Hurricane Law Firm Can Help:

- Protect your rights to recover under your wind and flood policy;

- Preparing your insurance claim;

- Completing a sworn proof of loss if so required;

- Assembling your claim documentation;

- Monitoring the claims process;

- Recorded statements if required by your insurance company;

- Examinations under oath if required by your insurance company;

- Hiring experts to evaluate the cost of repairs and prove other damages.

Read What Our Clients Say

Why Hire Lavis Law Firm

- We provide legal services on a contingency fee basis;

- We have recovered tens of millions of dollars in Hurricane damages;

- We have a network of property damage adjusters and other experts who we have worked with over the last 20 years and who can assist in the preparation of claim documents.

- We have an A+ BBB Rating;

- We have trained to use the estimating software;

- If you cannot meet at the damaged property address or another location, we handle many matters by video conference, telephone, internet, email, and can sign many documents digitally.

- We will fight hard on your behalf.

- We always try to respond as quickly and carefully as possible to your legal needs.

- We balance the speed of our service with the need to be thorough.

- We don’t want to take care of your legal needs quickly; we want to take care of them correctly.

- We promise to try to get you the results you need and deserve with experienced, dedicated legal professionals on your side.